Read the Full Report

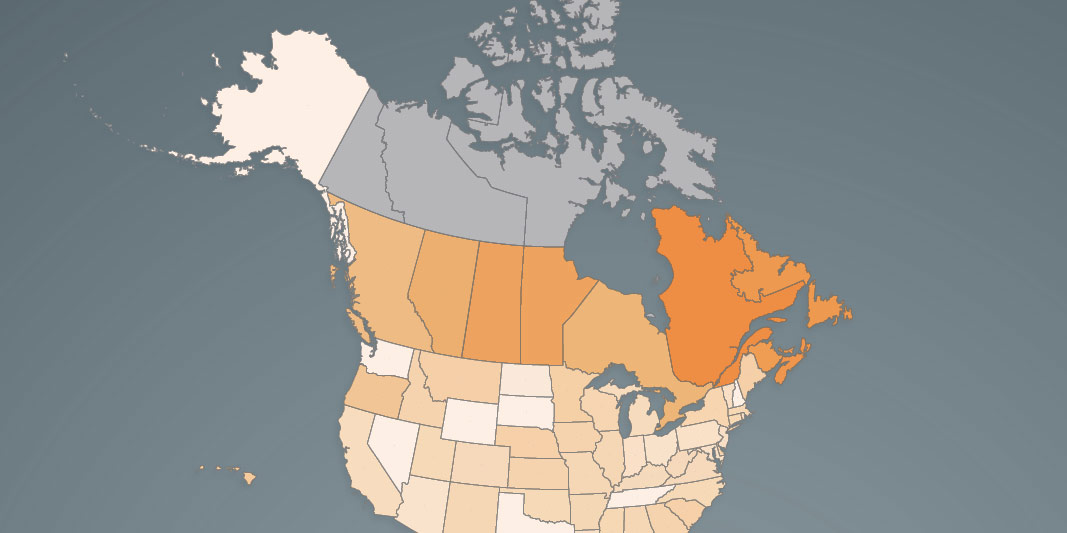

Read the Full Report View the Infographic - Income Tax Rate at CA$50,000

View the Infographic - Income Tax Rate at CA$50,000 View the Infographic - Income Tax Rate at CA$50,000 (Atlantic Canada)

View the Infographic - Income Tax Rate at CA$50,000 (Atlantic Canada) View the Infographic - Income Tax Rate at CA$75,000

View the Infographic - Income Tax Rate at CA$75,000 View the Infographic - Income Tax Rate at CA$75,000 (Atlantic Canada)

View the Infographic - Income Tax Rate at CA$75,000 (Atlantic Canada) View the Infographic - Income Tax Rate at CA$150,000

View the Infographic - Income Tax Rate at CA$150,000 View the Infographic - Income Tax Rate at CA$300,000

View the Infographic - Income Tax Rate at CA$300,000 Read the News Release - Canada

Read the News Release - Canada Read the News Release - Atlantic Canada

Read the News Release - Atlantic Canada