Alberta’s income tax hikes may generate less revenue than expected

As of October 1, the Government of Alberta moved away from the province’s single 10 per cent income tax rate to a system of five tax brackets with a top marginal rate of 15 per cent. While the increased rates will likely generate additional revenue, it will most likely be less than anticipated.

The economic literature suggests that when tax rates are increased, individual tax filers—especially upper-income earners—are able to find legal means to mitigate those tax increases.

For instance, people can decide to work less, accept more tax-friendly fringe benefits rather than additional taxable salary, channel income through a small business, or simply move their income to another jurisdiction with lower tax rates. This means the additional revenue generated by tax increases can be less than expected if the government hasn’t accounted for those behavioural changes.

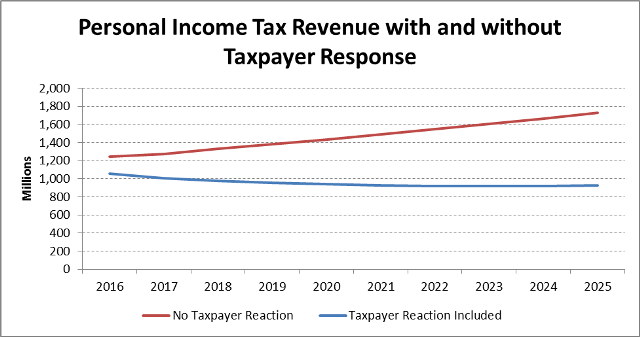

In a recent study, we calculated the amount of revenue the government can expect under two scenarios: one where behavioural changes are accounted for (dynamic) and one where they are not (static). If the government is budgeting based on a static model, the difference between the static and dynamic models will represent an unexpected revenue shortfall that could perpetuate the province’s ongoing deficits.

The chart below shows the estimates for the static and dynamic models. Over the 2016 to 2020 period, the cumulative difference between the static and dynamic estimates is $1.7 billion, representing a 25.8 per cent shortfall. The difference grows to $5.1 billion over the 2016 to 2025 period, a shortfall of 34.9 per cent.

If the Alberta government’s fiscal plan relies on the overly optimistic static estimates, it could add $1.7 billion more than it expects of extra debt during its mandate.

This would worsen the province’s fiscal situation.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.