Resource revenues are set to increase substantially.

Government Spending & Taxes

In 2020, the federal expenditure share jumped to 40 per cent.

Government spending represented 40.4 per cent of the country's economy in 2019, up from 37.4 per cent in 2007.

In the last year of reliable data before the pandemic, government spending in Nova Scotia represented 60.2 per cent of the economy.

A lack of fiscal prudence left Canada vulnerable when the pandemic hit.

Canada's productivity growth and levels of business investment have been lacklustre for decades.

The NDP election platform called for per-person spending to reach $11,446 in 2022/23.

On average, couples with children in the bottom 20 per cent pay $318 per year more than they did previously.

Alberta, Saskatchewan and Newfoundland require the most policy action to correct their unsustainable fiscal trajectories.

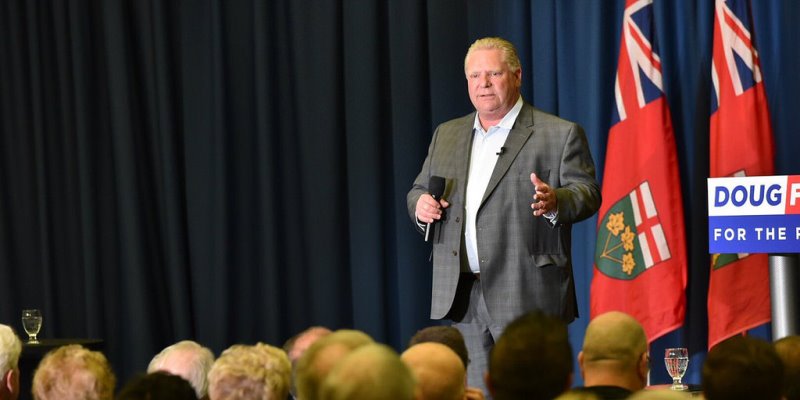

The Ontario government plans to increase the minimum wage to $15 in January.

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.