For now, the new wage subsidy program will cost $71 billion.

Government Spending & Taxes

Default risk and exchange-rate risk increase for foreign lenders as they increase their holdings of any government’s debt.

Provincial government debt-service costs are set to reach $13.2 billion this year.

Effectively, the CERB will now cost $40 billion, up from $15 billion.

The principle of no taxation without representation is central to the concept of democracy.

Ottawa will spend up to $27 billion supporting individual Canadians and businesses.

Alberta saw spending reductions of 20 per cent during the reforms of the 1990s.

The unemployment rate rose to 5.9 per cent, in the biggest one-month jump since the 2009 recession.

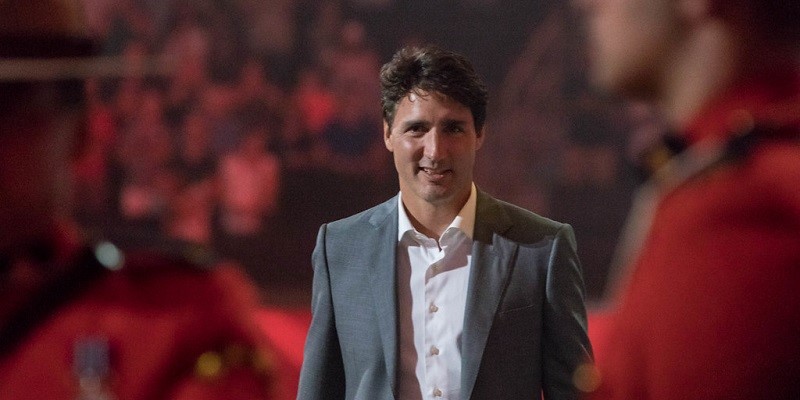

Since Justin Trudeau entered office, per-person spending has increased by 17.5 per cent in just four years.

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.