Ontario’s large debt grew in a hurry

The release of Canadian Government Finance Statistics for 2013 reveals that the per capita net financial worth of most provincial and territorial governments stabilized in 2013 and the net liabilities of some provinces and territories decreased from 2012.

However, there were notable exceptions to this provincial trend: net liabilities per capita rose in Newfoundland and Labrador, Nova Scotia, New Brunswick, Ontario and Alberta in 2013. However, net government liability per capita in Ontario—in other words, Ontario’s per capita indebtedness—remains the highest among the provinces and territories totalling $19,301 in 2013. (See chart below)

In Ontario, where the government is presenting a fiscal update today, persistent and growing provincial government debt is a chronic story of poor fiscal management. While Ontario was seriously hit by the effects of the 2009 recession, its current net public debt is actually the product of half a century of debt accumulation. Moreover, the pace of debt accumulation quickened starting in 2007.

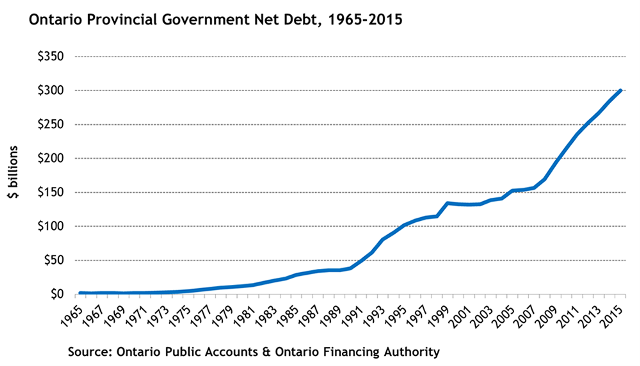

Over the period 1965 to 2015, Ontario’s net public debt grew from $1.6 billion to $300 billion dollars (See chart below)

This growth has occurred in several phases. From 1965 to 1989, the net public debt grew from $1.6 billion to $35.4 billion. It reached $38.4 billion in 1990 and then grew to $134.4 billion by 1999. Ontario’s debt then stabilized for a number of years and by 2002 had actually decreased slightly to $132.6 billion. In 2003, Ontario’s net debt resumed growing with a vengeance and between 2003 and 2015 grew from $138.8 billion to $300 billion.

Ontario’s net public debt represents all accumulated liabilities plus interest since its creation as a province of Canada in 1867. Since 1990, Ontario has accumulated nearly $265 billion in net public debt. Put another way, nearly 90 per cent of Ontario’s net public debt has been accumulated over only the last 25 years.

This mass of debt now requires $11.4 billion a year in debt servicing—money that is therefore not available for important programs in health and education.

Such is the price of profligacy.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.