After the COVID crisis has passed, Ottawa should find ways to encourage private-sector investment and hiring.

Government Spending & Taxes

Ottawa raised personal income tax rates on Canadian workers.

The Ford government projected a deficit of $20.5 billion for 2020-21.

The lack of innovation in the government sector is rooted in the differences between the incentives and disciplines imposed by customers on the government and private sectors.

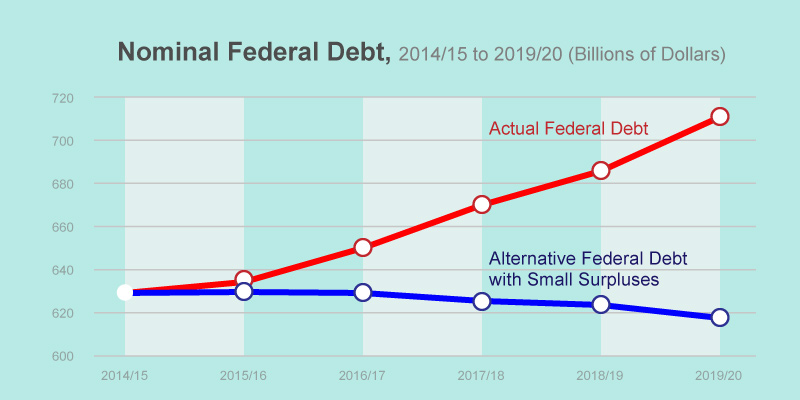

The Trudeau government has run five consecutive deficits since taking office in 2015 and is expected to have accumulated approximately $84.3 billion in federal debt—$713.2 billion total—by the end of 2019-20.

Prices are almost completely nonexistent for government-provided goods and services.

Federal deficit estimates range from $100 billion to $200 billion for fiscal year 2020-21.

The COVID crisis combined with the oil-price war will reduce revenue and trigger spending increases.

Whereas the Chrétien government used balanced budgets as a guiding fiscal anchor, the Trudeau government has not had an effective fiscal rule imposing discipline on its spending, taxing, and borrowing decisions, resulting in the federal government being less prepared to respond to the current recession.

The auditor general noted there were 3.8 million more social insurance numbers for Canadians 20 years and older than actual people in that age group.

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.