The NFL has changed the rules over time, to better protect quarterbacks and promote a more offensively-oriented game.

Other Topics

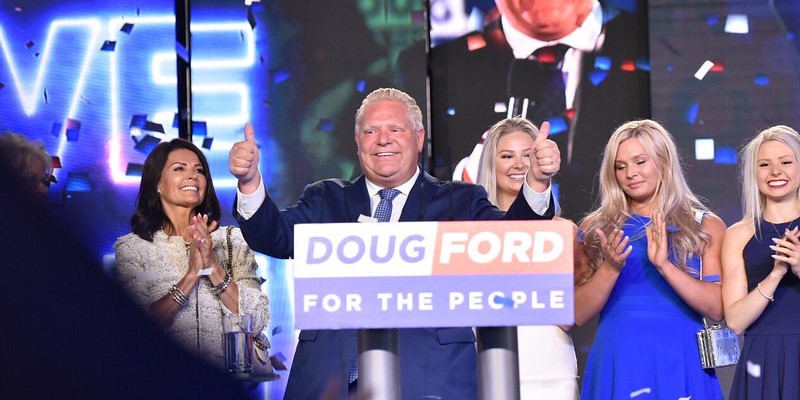

Under the Ford government, inflation-adjusted per-person spending has increased by 2.4 per cent annually.

Only 39 per cent of Australians support a broad-based increase in personal income taxes.

Government workers in Ontario retire 2.5 years earlier (on average) than those in the private sector.

Public-sector capital investment is pegged at $48.5 billion over the next three years.

The province’s current spending levels greatly exceed its tax revenues.

For the province's top earners, each new dollar they earn is taxed at 53.53 per cent.

Program spending is projected to be $4.2 billion higher in 2023/24 than budgeted just a few months ago.

The province will run a $4.2 billion operating budget deficit in 2023/24.

The province now has the fourth-highest top personal income tax rate in Canada and the United States.

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.