Alberta’s Lost Advantage on Personal Income Tax Rates

— Publié le 20, February, 2020

Summary

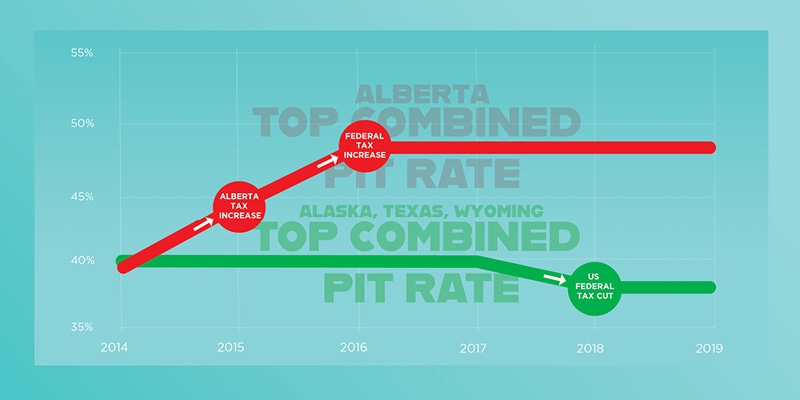

- As recently as 2014, Alberta had the lowest combined top federal/provincial or federal/ state marginal personal income tax (PIT) rate in Canada or the United States—a cornerstone of what was once known as the “Alberta tax advantage.”

- Tax policy changes at the provincial and federal levels combined to increase Alberta’s top marginal PIT rate by nine percentage points: from 39 percent to 48 percent.

- Also during this period, federal tax reform in the United States lowered the top federal personal income tax bracket by 2.6 percentage points: from 39.6 to 37 percent.

- The combined effect of these policy changes is that Alberta has lost its status as having the lowest top combined PIT rate in North America, where it is now the tenth highest.

- In addition, Alberta’s top PIT rate applies at a significantly lower threshold than several resource-intensive U.S. states.

- The recent (October 2019) announcement of a pause in Alberta’s indexation of tax brackets and tax credits means that the personal income tax burden on Albertans will continue to grow.