A Primer on Modern Monetary Theory

Modern Monetary Theory (MMT) is a policy model for funding government spending. While MMT is not new, it has recently received widespread attention, particularly as government spending has increased dramatically in response to the ongoing COVID-19 crisis and concerns grow about how to pay for this increased spending.

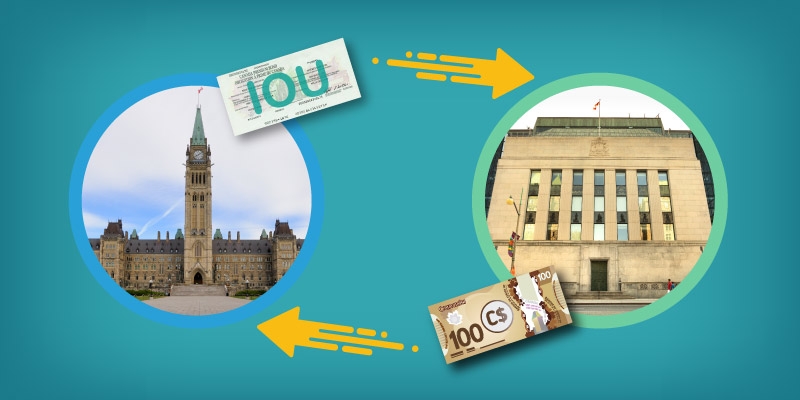

The essential message of MMT is that there is no financial constraint on government spending as long as a country is a sovereign issuer of currency and does not tie the value of its currency to another currency. Both Canada and the US are examples of countries that are sovereign issuers of currency. In principle, being a sovereign issuer of currency endows the government with the ability to borrow money from the country’s central bank. The central bank can effectively credit the government’s bank account at the central bank for an unlimited amount of money without either charging the government interest or, indeed, demanding repayment of the government bonds the central bank has acquired. In 2020, the central banks in both Canada and the US bought a disproportionately large share of government bonds compared to previous years, which has led some observers to argue that the governments of Canada and the United States are practicing MMT.

A related message of MMT is that increased government spending in pursuit of a variety of economic and social goals is socially desirable. MMT is arguably an expeditious way of funding increased government spending by obviating the need for government to raise additional tax revenues or to compete for private capital by offering competitive interest rates on government bonds sold to private sector investors.

The MMT policy model has been met with a number of objections. One is that central banks, such as the Bank of Canada, may not concur with government requests to fund the latter directly by purchasing government bonds. In principle, the Bank of Canada, as well as the central banks of other wealthy countries, are nominally independent of government control or funding mandates. However, since both Canada’s Parliament and the US Congress can legally alter the charters of their respective central banks, the de facto independence of the Bank of Canada and the US Federal Reserve ultimately exists at the will of the Canadian and US governments.

A second objection to MMT is that its implementation will lead to inflation, perhaps even hyper-inflation, with devastating consequences for domestic economies. MMTers acknowledge the potential for increased government spending financed by the central bank to generate problematic inflation in a “full employment” economy. However, most MMTers see a low risk of inflation pursuant to increased government spending given current economic conditions, including relatively high unemployment as well as recent experience of relatively low inflation notwithstanding growing amounts of government borrowing. MMTers also note that government can reduce its spending or increase taxes in the event that inflation is becoming a problem.

Whether government has the political will and technical ability to raise taxes and/or cut spending in response to rising risks of faster inflation is an open question. Hence, while the risk of MMT igniting a sustained and relatively fast rate of general price increases is uncertain, there has been relatively recent historical experience in Latin America and Greece where the implementation of MMT did, indeed, result in runaway inflation and a significant decline in the standards of living in the relevant countries. This experience is cautionary tale for those proposing adoption of the MMT framework.