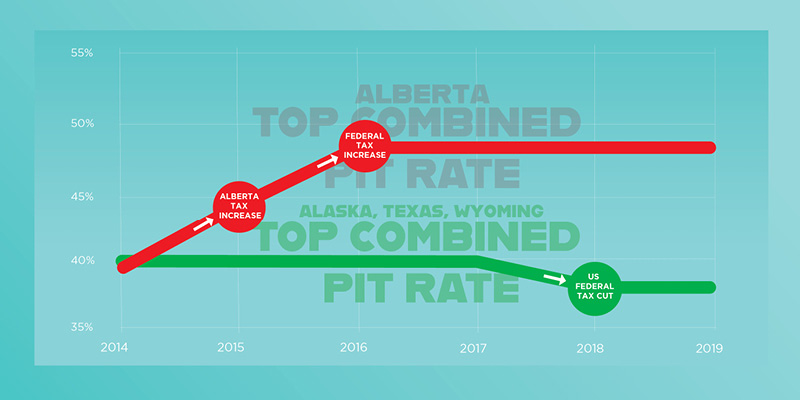

In 2015, the government replaced the single-rate personal income tax with five tiers that include a top rate of 15 per cent.

alberta taxes

Juillet 21, 2021

11:39AM

Juillet 8, 2020

12:07PM

In 2016, the Trudeau government added a new top personal federal income tax rate, increasing the top rate to 33 per cent.

Juin 23, 2020

8:37PM

Canada's equalization program cost Alberta taxpayers approximately $3.1 billion in 2017.

Juin 3, 2020

11:28AM

The province's corporate income tax rate would drop from 12 per cent to 8 per cent.

Mars 5, 2020

10:22AM

The Trudeau government created a new top tax bracket that raised the top federal rate to 33 per cent.

Octobre 16, 2019

10:18AM

The top combined personal income tax rate in Alberta is now 48 per cent compared to 39 per cent in 2014.

Octobre 16, 2019

9:56AM

The most successful deficit-elimination efforts in recent Canadian history featured shorter timelines.

Septembre 16, 2019

10:11AM

Alberta’s scores dropped on all survey questions.