Reversing course and raising the age of eligibility for retirement benefits to 67 from 65 would be politically costly, but it makes eminent sense when one considers the aging of our population.

canada pension plan

CPP expansion will mean several thousands of dollars more in annual contributions from working Canadians.

An expanded Canada Pension Plan naturally comes with higher CPP taxes.

High marginal effective tax rates weaken the incentives for people to earn extra money.

The new Canada Child Benefit program, and the expansion of the CPP, may hurt middle-income Canadians.

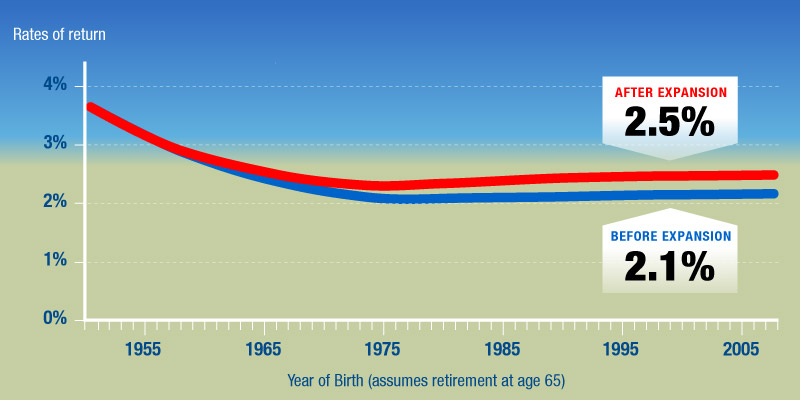

The rate of return Canadians—especially younger workers—will receive on their CPP contributions is meagre and will remain so even after expansion.

Canadians born in 1971 or after can now expect to receive a meagre rate of return from their CPP contributions of between 2.3 per cent and 2.5 per cent (depending on their specific year of birth).

Most Canadians are adequately prepared for retirement, making CPP expansion largely unnecessary.

The returns of the CPP's investment arm in no way influence the CPP retirement benefits received by Canadian workers.