Albertans contributed about 16 per cent of total CPP contributions but received only 12 per cent of total CPP benefits.

CPP benefits

Octobre 20, 2023

12:37PM

Albertans have paid significantly more into the CPP than its retirees have received in return.

Janvier 6, 2021

10:53AM

Unlike an RRSP or TFSA, the CPP does not allow Canadians to withdraw money early.

Avril 4, 2018

12:25PM

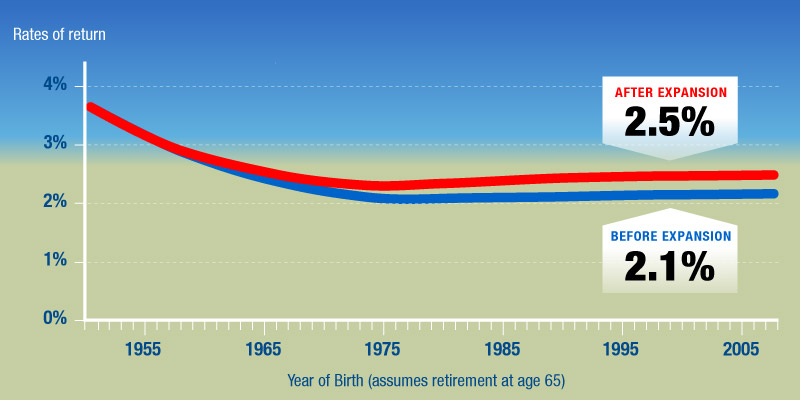

Canadians born after 1970 can expect a rate of return on their CPP contributions of between 2.3 per cent and 2.5 per cent.

Janvier 17, 2018

1:05PM

The program is designed so Canadians who die early in life subsidize those who live longer.

Décembre 14, 2017

11:04AM

For retirees born after 1993, the CPP rate of return will be a meagre 2.5 per cent.

Juillet 28, 2016

3:22PM

The rate of return Canadians—especially younger workers—will receive on their CPP contributions is meagre and will remain so even after expansion.

Juillet 7, 2016

11:21AM

In 2014, savings in non-pension assets totalled $9.5 trillion, dwarfing the $3.3 trillion assets in the formal pension system.

Juin 22, 2016

3:00AM

Canadians may be forced to contribute up to an extra $3,250 more to the CPP each year.