A higher CPP benefit could trigger a reduction in federal (and provincial) government benefits targeted at low-income seniors.

CPP

Finance Minister Bill Morneau will soon meet with his provincial counterparts to discuss CPP expansion, which could include increased mandatory contributions.

For working Canadians, contributions to the Canada Pension Plan (CPP) are a regular bill observed on their paycheques.

The Fraser Institute has been at the fore of publishing work related to pension issues and correcting misconceptions to provide Canadians with better information.

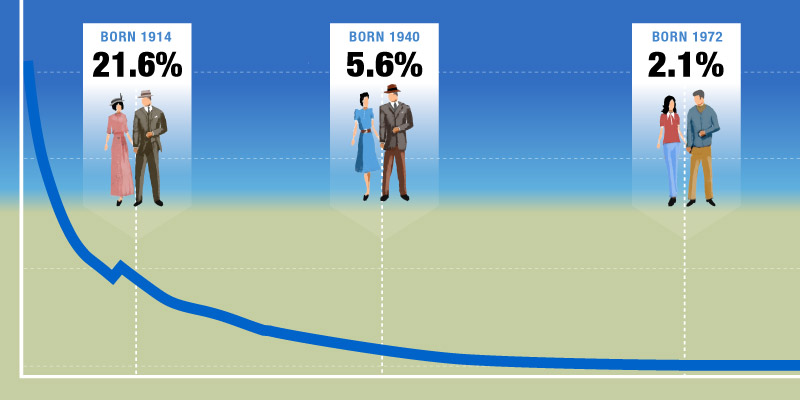

The percentage of seniors living in low-income has consistently fallen over the past four decades.

The Ontario government claims the ORPP is necessary because we aren’t saving enough for retirement, but a number of recent studies show there is no retirement savings crisis in Canada.

Proponents of an expanded CPP ignore the ample resources already available to Canadians when they retire.