income tax rates

From 2013 to 2022, per-person economic growth—a broad measure of living standards—was at its lowest rate since the Great Depression.

From 2015/16 to 2022/23, the government added more than $820 billion in gross federal debt.

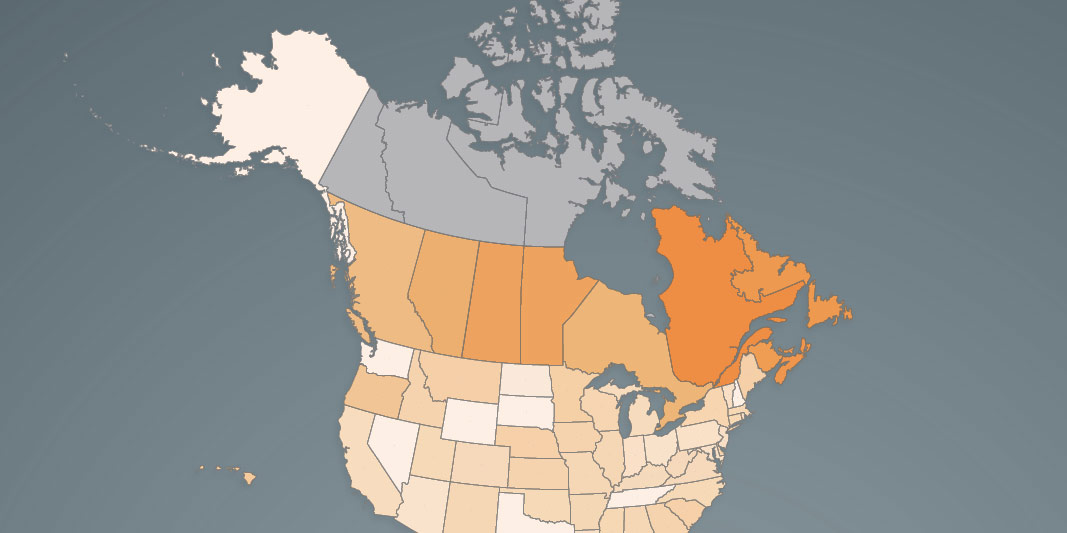

The province had the fourth-highest top combined income tax rate among 61 Canadian and U.S. jurisdictions.

The quarterly declines in real per-person GDP have occurred before, during and after the pandemic.

Salaries for municipal government staff in Toronto were an estimated 11.2 per cent higher than private-sector rates.

More than 60 per cent of lower-income families now pay higher federal income taxes.

The federal carbon tax will rise to $80 per tonne this year.

The federal government raised the top income tax rate from 29 per cent to 33 per cent.