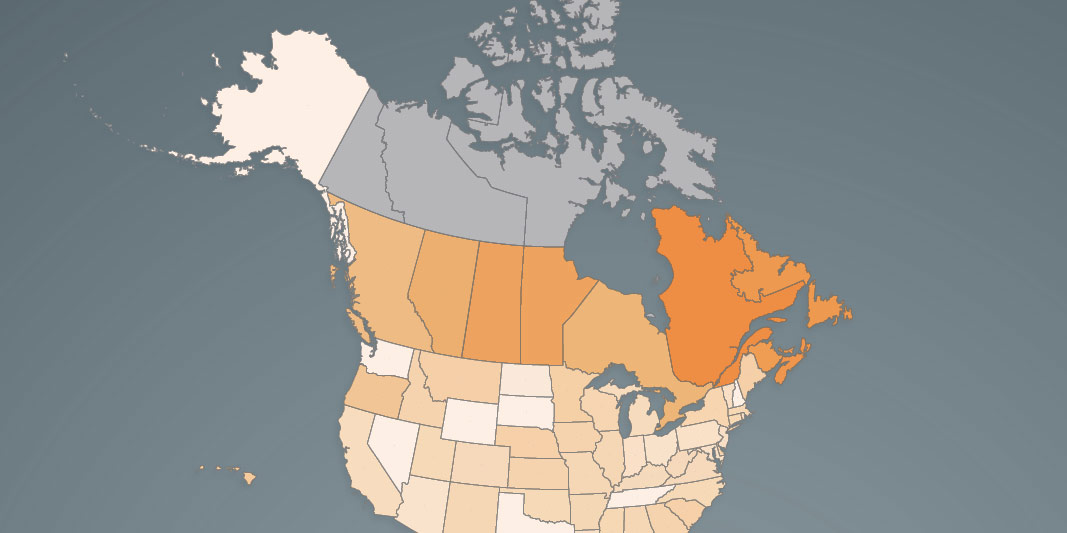

An individual making C$50,000 per year faces a higher income tax rate in Ontario than in every U.S. state.

personal income tax rate

Janvier 16, 2024

11:17AM

According to polling data, 80 per cent of Canadians don’t want average families to pay more than 40 per cent of their income in taxes.

Août 29, 2023

5:30AM

The bottom 20 per cent of income-earning families pay 0.7 per cent of all federal and provincial personal income taxes.

Août 17, 2023

3:30AM

The top tax rate in Sweden applies to income starting at roughly US$62,000 compared to between US$535,000 and US$1 million in the United States.

Juillet 7, 2023

2:30AM

The average family in the province will pay more than 45 per cent of its income in taxes this year.

Février 23, 2023

9:07AM

Support for socialism drops from 50 per cent among Canadians 18-24 years old to 38 per cent among Canadians over 55.

Juillet 20, 2022

9:52AM

In 2023/24, de-indexation could cost Albertans $706 million.