Only 16 per cent of Canadians said they receive good or great value for their tax dollars.

personal tax rates

Avril 25, 2024

2:30AM

Avril 23, 2024

5:30AM

Flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

Avril 15, 2024

10:13AM

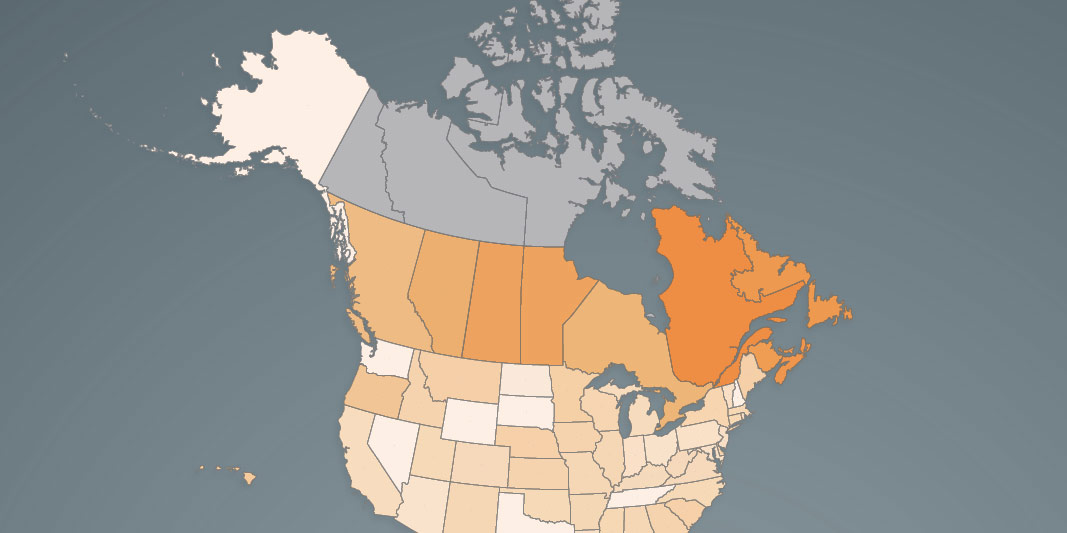

An individual making C$50,000 per year faces a higher income tax rate in Ontario than in every U.S. state.

Avril 10, 2024

12:52PM

The province had the fourth-highest top combined income tax rate among 61 Canadian and U.S. jurisdictions.

Juillet 17, 2023

8:11AM

The top 20 per cent of income-earning households paid 61.4 per cent of the country’s personal income taxes in 2022.

Mars 1, 2023

4:00PM

For the province's top earners, each new dollar they earn is taxed at 53.53 per cent.