No fault coverages add $300 million to ICBC’s costs—that’s $74 for each passenger car.

auto insurance

ICBC is heading for a $1.3 billion loss this year.

On average, ICBC's $15,000 repair bill for a luxury car is roughly six times higher than for a typical car.

As a publicity stunt, the recent New Democratic Party proposal to limit withdrawal fees at some automated teller machines (ATMs) at fifty cents worked well. But getting publicity for an idea, including a poor one, is one thing; getting attention to useful reforms that will greatly benefit consumers is quite another. The ATM idea is a good example of the former and not the latter.

The recent revelation from the Finance Ministrys probe into Crown corporations that found ever-more and ever-higher paid managers at ICBC has enraged British Columbians and especially consumers of auto insurance in this province.

It is of course entirely possible that ICBC, a government-owned monopoly, has too many managers and that theyre paid too much.

If the B.C. government is looking for a policy issue thats sure to be a winner with voters, it need look no further than the issue of the provinces high auto insurance rates.

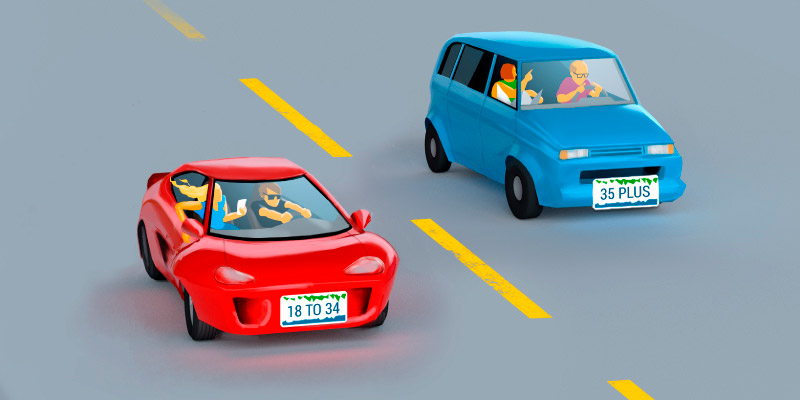

Contrary to the myth promoted by public auto insurance monopolies and their supporters, B.C. drivers pay higher premiums relative to drivers in most other provinces, a fact confirmed by a new comparison of automobile insurance premiums across all 10 provinces. The average premium paid by B.C. drivers exceeded $1,100 in 2009.