Capital gains taxes are on the rise in Canada because various provinces, and the federal government, have increased their personal income tax rates.

canadian income tax

April 6, 2017

10:38AM

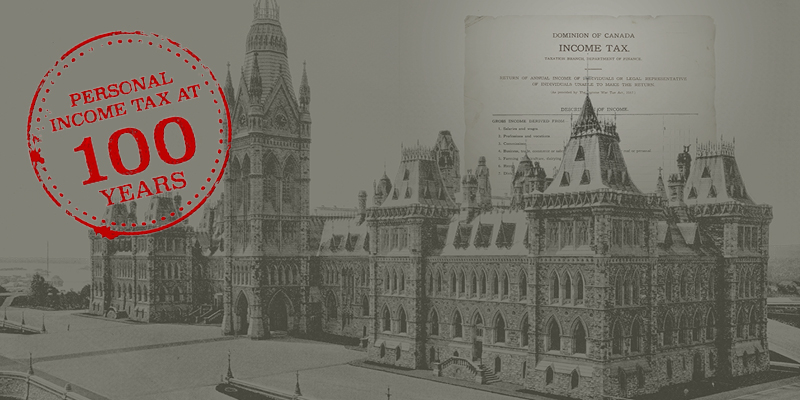

The 1917 tax form, which was for both personal and corporate income, has just 23 just lines for the taxpayer.

April 6, 2017

1:00AM

March 20, 2017

12:29PM

The cost of complying with Canada’s personal income tax system is roughly $501 per household each year.

March 16, 2017

2:37PM

Consumption is now a more reliable tax base upon which to promote economic growth and fairness.

March 1, 2017

9:03AM

The Trudeau Liberals have raised the top personal tax rate on many of Canada’s highly skilled and educated workers.

January 17, 2017

3:00AM

It’s not clear what “tax fairness” means to Prime Minister Trudeau.

January 4, 2017

3:00AM

After peaking in 2006, the share of the one per cent has steadily declined from 13.7 per cent to 11.6 per cent in 2014.

October 26, 2016

12:11PM

Amazingly, the federal government offers no cost estimates of more than 90 tax expenditures.

August 31, 2016

9:09AM

On health care, despite a high level of spending, Canadians have comparatively poor access to technology and doctors, and long wait times for surgery.