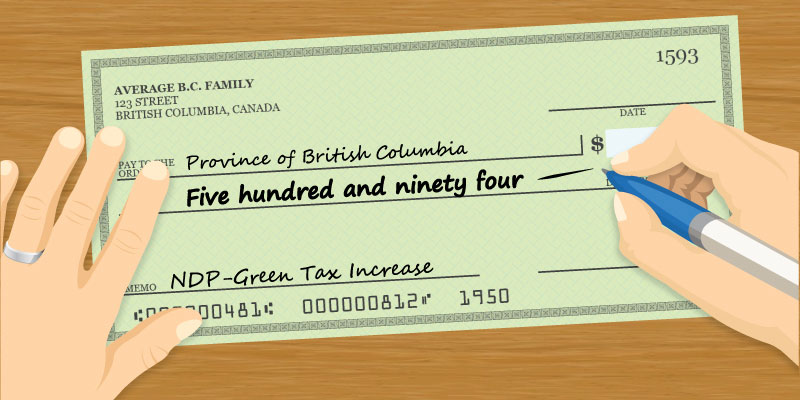

The NDP and Green Party both want to raise B.C.’s top personal tax rate.

personal income tax

April 27, 2017

9:31AM

As the tax deadline looms, here’s a brief history of Canada’s federal income tax, which has changed dramatically over the years.

April 25, 2017

3:00AM

Canadians spent $501 per household simply complying with the personal income tax system.

April 24, 2017

1:02PM

When governments raise PIT rates, there are both direct and indirect costs for private sector.

April 19, 2017

2:05PM

Ontario’s top combined personal income rate is 53.5 per cent—one of the highest rates in the developed world.

April 18, 2017

3:00AM

Today the personal income tax accounts for almost half of federal revenues.

April 12, 2017

3:00AM

In 1938, only 2.3 per cent of the population filed personal income taxes.

April 10, 2017

12:23PM

In the early years, as few as one in 50 Canadians paid income tax.

April 7, 2017

3:00AM

Capital gains taxes are on the rise in Canada because various provinces, and the federal government, have increased their personal income tax rates.