Ontario Budget: dark cloud of government debt continues to hang over the province

Today, the Wynne government tabled a budget with a bit of good news for Ontarians. Specifically, we learned that the operating deficit in 2015/16 will be somewhat smaller (at $5.7 billion) than was previously expected ($7.5 billion)—due largely to an annual spike in revenue.

The government also revised its projected deficit for next year slightly, down to $4.3 billion. And Finance Minister Charles Sousa assured Ontarians “this will be the last deficit before we erase it completely in 2017/18.” While we appreciate the finance minister’s statement, there remain risks to this target on both the expenditure and revenue sides of the ledger.

Ontario continues to face significant fiscal challenges and the fact is spending restraint will be required in the years ahead. Despite the good news about this year’s deficit, it is hardly reason to celebrate.

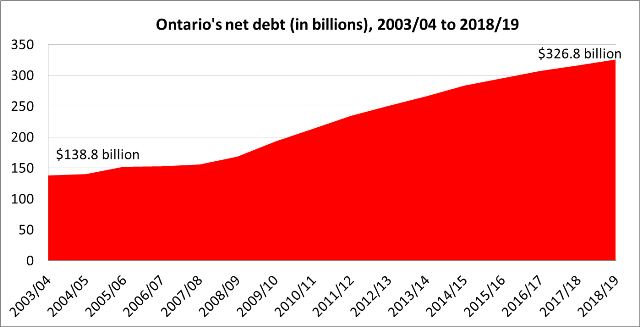

The downward revisions in the province’s deficit projections (totalling $2 billion between this year and next) can be put into context by considering that the province has increased its net debt by a total of approximately $160 billion between 2003/04 and 2015/16. In total, Ontario’s net debt is projected to reach $317 billion in 2017/18, about $22,500 per person.

The silver lining of a slightly smaller annual deficit should not distract from the dark cloud of government debt that continues to hang over Ontario’s economy.

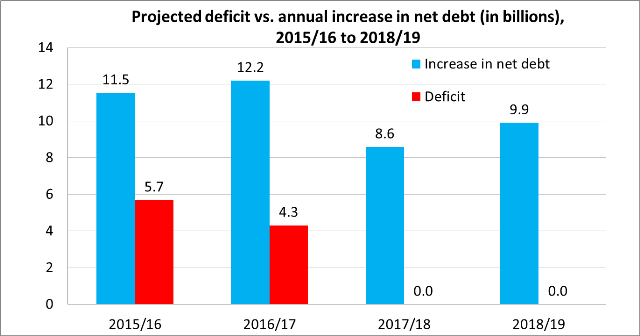

It is also important to recognize that Ontario plans to acquire significantly more debt in the years ahead, even if it meets its balanced budget target in 2017/18 (see chart below). That is because the province is planning substantial debt-financed capital spending, which does not fully show up in the operating budget.

Just how much more debt is Ontario expecting to acquire between now and 2018/19?

The chart below shows that the Ontario government estimates it will add $11.5 billion in net debt in 2015/16, and that it expects to continue to add significant debt in each of the next three years. Specifically, the government expects to increase its net debt by $12.2 billion in 2017/18, $8.6 billion in 2017/18 and $9.9 billion in 2018/19.

In total, the province expects its net debt to grow by more than $40 billion relative to 2014/15 level. As a result of this increase in debt, the province expects to make very little progress in the years ahead in terms of reducing the province’s debt-to-GDP ratio, which has climbed rapidly from 27.2 per cent of GDP in 2003/04 to 39.6 per cent this year.

The government projects that this number will decline very slightly to 38.5 per cent of GDP by 2018/19—still one of the highest levels in Canada, and much higher even than was the case during the mid-1990s when the province’s debt exploded under Premier Bob Rae. Balancing the budget is important but Ontario also needs a plan to halt the accumulation of debt and decrease its elevated debt-to-GDP ratio. Today’s budget failed in this regard.

Of course, it is good news that the province’s deficit is somewhat smaller than previously expected. However, this salutary development should not distract from the seriousness of the fiscal problems still facing Ontario.

Authors:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.