Ford should get serious about Ontario's deficit

Ontario’s long string of operating deficits, and resulting run-up in government debt (projected to hit $325 billion this year) raises a $325 billion question: How will Premier Doug Ford’s new government tackle the province’s fiscal woes, which have weighed heavy around the necks of Ontarians?

First, let’s review the situation. At the end of this year, Ontario will have run 10 operating deficits in 11 years. Because operating deficits largely exclude spending on long-term capital projects (roads, bridges, etc.), they’re a useful measure of whether or not the government is paying “day-to-day” bills in any given year with money coming in that year.

So why have Ontario’s deficits lasted so long? To answer this, we must look at the previous Liberal government’s deficit-reduction strategy following the 2008/09 recession.

Despite the big deficit and the rapid run-up in spending during the recession, the Liberal government under Dalton McGuinty (and later under Kathleen Wynne) refused to reduce spending to deal with the issue in a timely manner. Instead, they continued to increase spending—crucially, at a slower rate than the growth in revenue. The hope was that revenue would catch up to expenditures and the deficit would slowly shrink.

Ontarians are still paying for this strategy today. By choosing to shrink the deficit slowly, the government remained in the red year after year for a long time, adding to the provincial debt. Yes, from 2009/10 to 2016/17, the annual deficit got smaller most years. But the government still spent more than it took in, so the debt kept growing.

Moreover, these operating deficits were often accompanied by additional new debt for capital projects, accelerating annual debt growth. That’s partly why the province’s net debt soared from $194 billion in 2009/10 (the year the deficit peaked) to $308 billion the year the deficit was finally (briefly) eliminated in 2017/18.

And even in 2017/18, when the Wynne government claimed balance, independent analysts (including the province’s own Financial Accountability Office) called those balanced budget claims into question.

Clearly, Ontario can’t afford another slow ambling walk towards a balanced budget—as we have seen, the cost of debt accumulation is high.

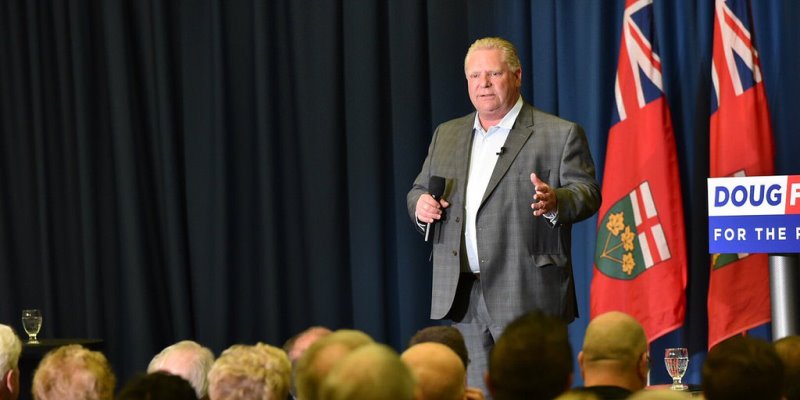

Now, here we are again, but this time Doug Ford’s Ontario PC government faces a budget deficit (thanks primarily to a big burst in government spending during the final two years of the last government), raising important questions about how to shrink it.

If the Ford government wants to get Ontario’s fiscal house in order, reduce the amount of government debt interest paid by Ontario taxpayers, and make room for badly needed tax relief, a budget plan that calls for another string of deficits should be a non-starter. According to Canadian history, successful deficit-elimination efforts often move much faster than that.

Premier Ford and his cabinet should view rapid deficit-elimination as a priority while recognizing it may well require nominal spending reductions—not just a slowdown in the rate of spending growth—to achieve this goal. The old maxim “slow and steady wins the race” does not apply to deficit reduction. If the Ford government is serious about repairing Ontario’s finances, history suggests it must come out of the blocks running.