How to restore Alberta’s tax advantage

As of 2014, Alberta had the lowest top personal and corporate income tax rates in North America. Fast-forward to today and the province has one of the highest top personal income tax rates and sits in the middle of the pack on corporate income tax rates.

Given the economic challenges Alberta faces, reducing rates to at least get back to near the front of the pack would be helpful. But given the new top federal tax bracket and tax cuts stateside, getting back to the lowest personal and corporate income tax rates isn’t just a matter of going back to the old single 10 per cent corporate and personal income tax rate.

So what would it take to get back on top?

A recent Fraser Institute study shows that moving to a six per cent personal and corporate income tax rate would bring Alberta into a tie for the lowest combined federal-provincial corporate income tax rate in North America, and would give us one of the lowest top personal income tax rates.

Of course, given our province’s nearly unbroken run of deficits since 2008/09, the natural question is whether we can afford that type of tax reform. The answer is a qualified yes, though it would require offsetting measures on both the tax and spending side.

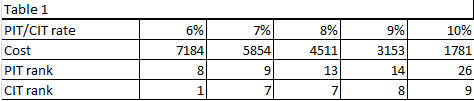

The table below shows that moving to a single six per cent personal and corporate income tax rate would cost $7.2 billion. Offsetting that cost would be challenging, but not impossible.

The provincial government would have a number of options at its disposal, such as bringing our unusually high basic personal and spousal exemptions roughly into line with other provinces, which would save $2.1 billion per year, and reducing corporate subsidies. On the spending side, a one per cent annual reduction in spending would save $550 million. Given that the provincial government has increased program spending by more than 1.5 times the combined rate of inflation plus population growth since 2004/05, and that the province spends roughly 20 per cent more per person than neighbouring British Columbia, surely there’s room for savings.

If such a government committed to pro-growth tax reform found some of the necessary offsets unpalatable, a somewhat more modest reform, setting the personal and corporate income tax rates at eight per cent, would still be enough to bring Alberta back into the top 10 in Canada and the United States on tax rates. As the table shows, moving to an 8 per cent rate would cost $4.5 billion. Or simply returning to the old 10 per cent single rate would cost less than $2 billion. Note that pairing the 10 per cent single rate with the reduction in the basic personal and spousal exemptions (while offsetting the cost to low-income earners who would otherwise have to pay income taxes) would be roughly revenue neutral.

Restoring Alberta’s tax advantage over most of its peers won’t be easy. But it would make Alberta a more attractive place to work and invest.