Government revenue during COVID—expected massive collapse never happened

The pandemic created an unprecedented economic disruption and fiscal response. Globally, the IMF has estimated that the world in 2020 ran a negative general government fiscal balance of 10.2 per cent of GDP (the value of all goods and services produced). In 2021 and 2022, that was forecast to shrink to 7.9 per cent and 5.2 per cent of GDP respectively.

Meanwhile, according to the IMF, Canada saw a negative fiscal balance of 10.9 per cent of GDP in 2020 with a forecasted 7.5 per cent in 2021 and 2.2 per cent in 2022. However, in keeping with our federal nature, the pandemic also had a differential effect on government finances in Ottawa and the provinces.

The federal government saw total revenues fall by 5.3 per cent in 2020/21 while revenues for the provinces collectively grew by 2.9 per cent, given transfer support from Ottawa for COVID. The subsequent year, both tiers of government saw revenues rise with Ottawa experiencing revenue growth of 17 per cent and the provinces collectively 10 per cent.

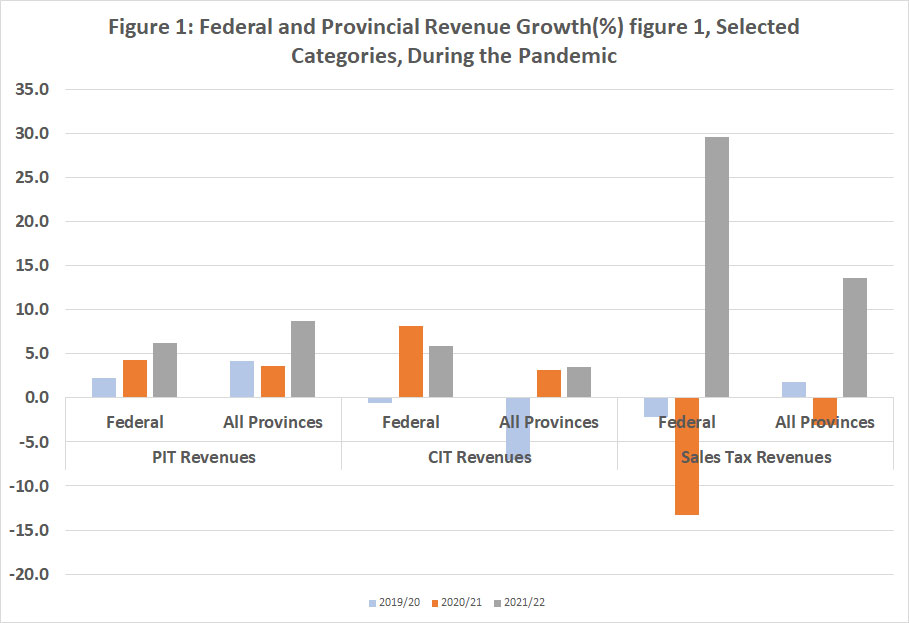

As illustrated in the first chart below, while corporate income tax (CIT) and general sales tax revenue took a hit at the federal and provincial levels during the first years of the pandemic, personal income tax revenue (PIT) didn’t.

In 2021/22, federal and provincial personal income tax revenues are estimated to have grown at 6.2 per cent and 8.7 per cent respectively, corporate income tax revenue at 5.9 per cent and 3.5 per cent and general sales tax revenues soaring by 29.6 per cent and 13.6 per cent respectively.

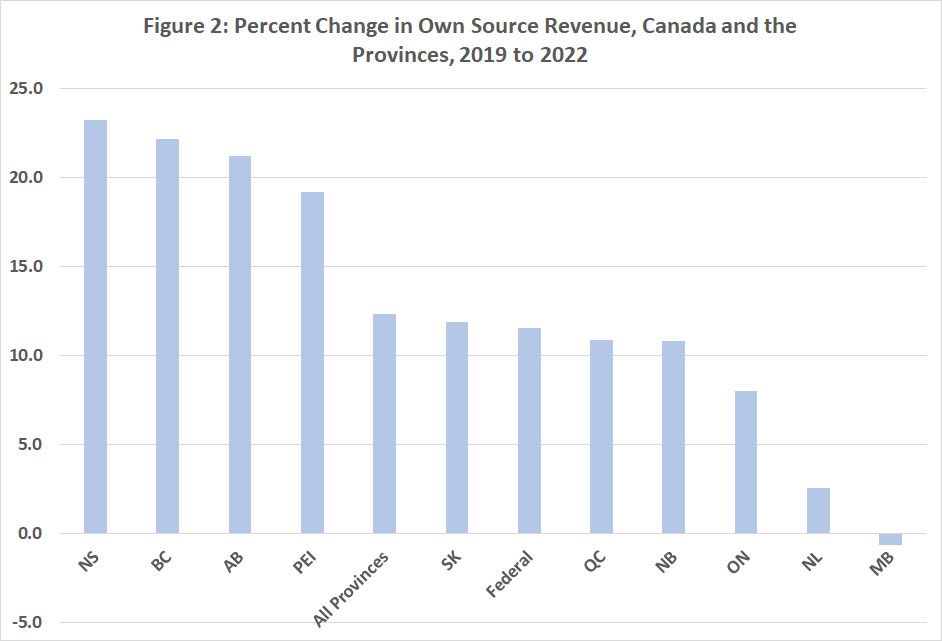

When total own-source revenues from 2019/20 to 2021/22 are examined, it becomes evident that the pandemic revenue collapse many expected never actually happened. The second chart shows that when a ranking is presented, a decline in own-source revenue only happened for one province (Manitoba), which saw an estimated one per cent decline in own-source revenue over the COVID period.

Even then, once transfer payments are factored in, all provinces saw an increase in total revenue (including Manitoba). Own-source revenue growth for the provinces ranged from highs of 23 per cent (Nova Scotia) and 22 per cent (British Columbia) to lows of 2.5 per cent (Newfoundland and Labrador) and -0.7 per cent (Manitoba).

In the end, the anticipated revenue apocalypse for governments did not come to pass.