Reversing course and raising the age of eligibility for retirement benefits to 67 from 65 would be politically costly, but it makes eminent sense when one considers the aging of our population.

CPP

The evidence does not support claims of a widespread retirement savings problem in Canada.

An expanded Canada Pension Plan naturally comes with higher CPP taxes.

The Liberal government remains committed to a misguided fiscal policy approach that spends borrowed money in the hopes of increasing prosperity.

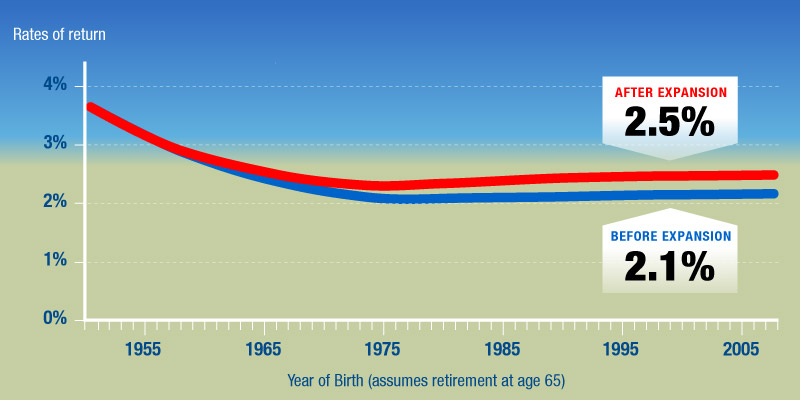

The rate of return Canadians—especially younger workers—will receive on their CPP contributions is meagre and will remain so even after expansion.

Canadians born in 1971 or after can now expect to receive a meagre rate of return from their CPP contributions of between 2.3 per cent and 2.5 per cent (depending on their specific year of birth).

The returns of the CPP's investment arm in no way influence the CPP retirement benefits received by Canadian workers.

The rate of return under the current CPP system is 2.1 per cent for Canadians born after 1971.

A narrow focus on pension assets overlooks non-pension assets such as stocks, bonds, real estate and other investments.