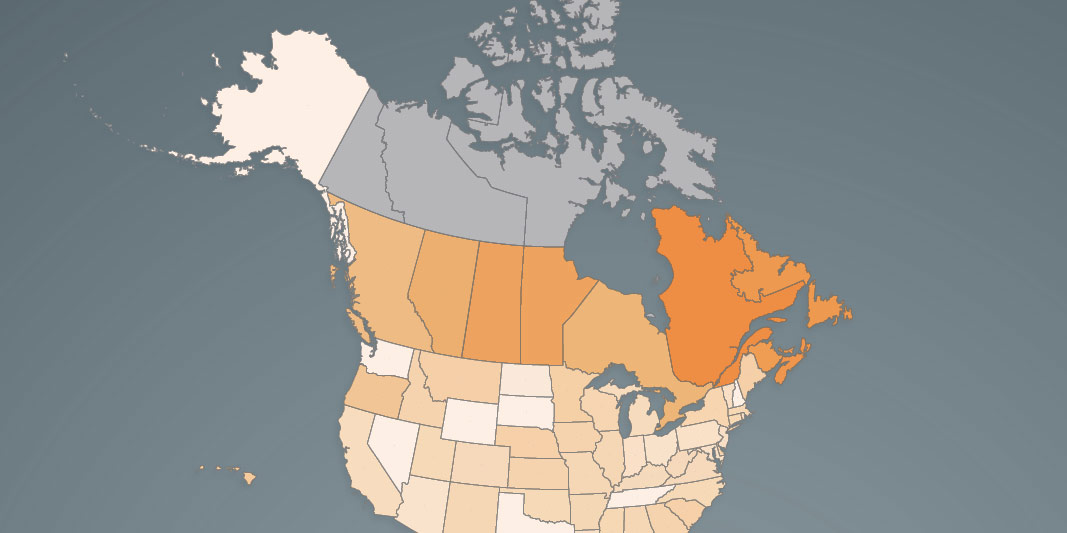

High-skilled workers in Ontario face a marginal tax rate at least 11 percentage points higher than the median U.S. state.

marginal tax rates

Août 19, 2024

8:53AM

Since 1961, the average family’s tax bill has increased 180.3 per cent after adjusting for inflation.

Août 16, 2024

8:38AM

The province has the fourth-highest top combined personal income tax rate among all provinces and U.S. states.

Août 6, 2024

8:44AM

This year the top 20 per cent of income-earning families in Canada will pay 54.2 per cent of total taxes.

Mai 17, 2024

9:38AM

Many Canadians who incur capital gains taxes, such as small business owners, may only do so once in their lifetimes.

Avril 19, 2024

9:02AM

The province had the third-lowest level of per-worker business investment in Canada.

Avril 15, 2024

10:13AM

An individual making C$50,000 per year faces a higher income tax rate in Ontario than in every U.S. state.

Décembre 18, 2023

2:30AM

High marginal tax rates on personal income can affect rates of charitable giving.