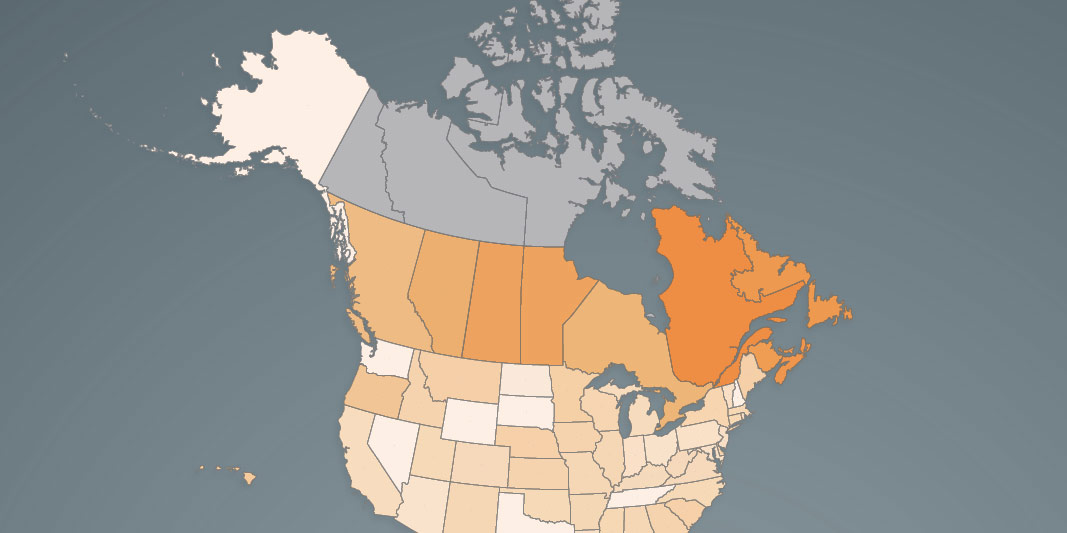

Workers in every province, across most of the income spectrum, faced higher income tax rates than workers in nearly every U.S. state.

tax rates

Octobre 30, 2024

11:37AM

The province's debt will reach $429 billion this year.

Septembre 19, 2024

3:30PM

High-skilled workers in Ontario face a marginal tax rate at least 11 percentage points higher than the median U.S. state.

Août 16, 2024

8:38AM

The province has the fourth-highest top combined personal income tax rate among all provinces and U.S. states.

Mai 21, 2024

8:59AM

The Ontario government expects a net debt increase of more than $24 billion this year alone.

Avril 19, 2024

9:02AM

The province had the third-lowest level of per-worker business investment in Canada.

Avril 10, 2024

12:52PM

The province had the fourth-highest top combined income tax rate among 61 Canadian and U.S. jurisdictions.

Décembre 11, 2023

2:30AM

The federal government raised the top income tax rate from 29 per cent to 33 per cent.