The government offset the benefits of the lower tax rate by eliminating tax credits.

income tax rates

Février 9, 2021

10:32AM

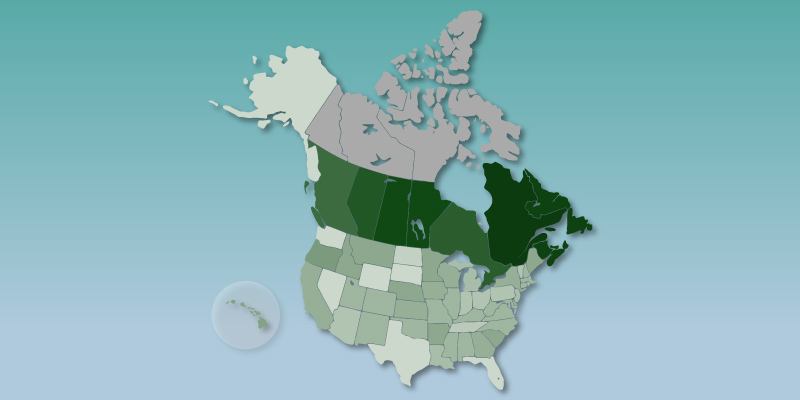

Canada has the seventh-highest top combined personal income tax rate in the OECD.

Juillet 7, 2020

12:00AM

Canada’s personal income tax rates are among the highest in the industrialized world.

Mars 4, 2020

8:56AM

Canada's economy is expected to grow by a tepid 1.6 per cent in 2020.

Février 18, 2020

3:52PM

The province’s top marginal PIT rate will increase from 16.8 per cent to 20.5 per cent.

Janvier 30, 2020

11:44AM

The government’s plan to increase the “basic personal amount” will cost nearly $7 billion annually.

Janvier 23, 2020

1:22PM

In Canada, 36.1 per cent of people in the top decile in 2017 were not in the top decile five years earlier.

Juillet 30, 2019

8:41AM

Some taxpayers change their behaviour when tax rates increase.