The province has one of the highest business tax rates in North America.

tax cuts

Since 2015, the number of employees at the Canada Revenue Agency increased from around 40,000 to almost 60,000.

From 2013 to 2022, per-person economic growth—a broad measure of living standards—was at its lowest rate since the Great Depression.

The province's program spending will reach $193.0 billion this year—an increase of $2.3 billion from the budget tabled in March.

The province's top combined income tax rate is 54 per cent.

The government’s plan to increase the “basic personal amount” will cost nearly $7 billion annually.

Nine of the provinces are in the top 10 jurisdictions in North America with the highest personal income tax rates.

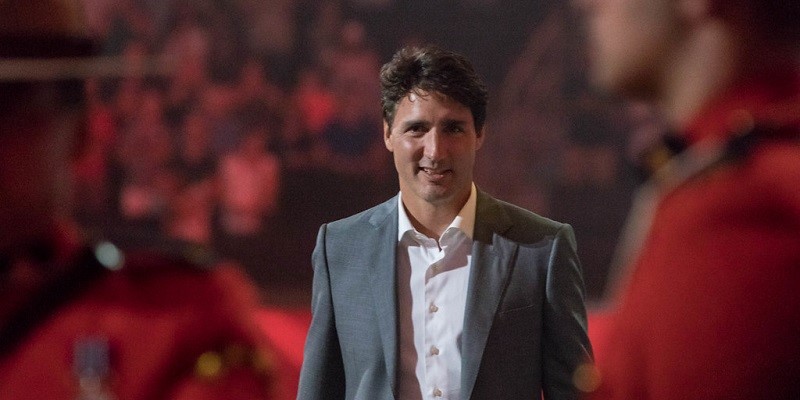

The Trudeau government raised the top income tax rate from 29 per cent to 33 per cent.

By eliminating several tax credits, Ottawa increased income taxes for many Canadians.