Government Spending & Taxes

— Apr 23, 2024

— Apr 9, 2024

Read the Full Report

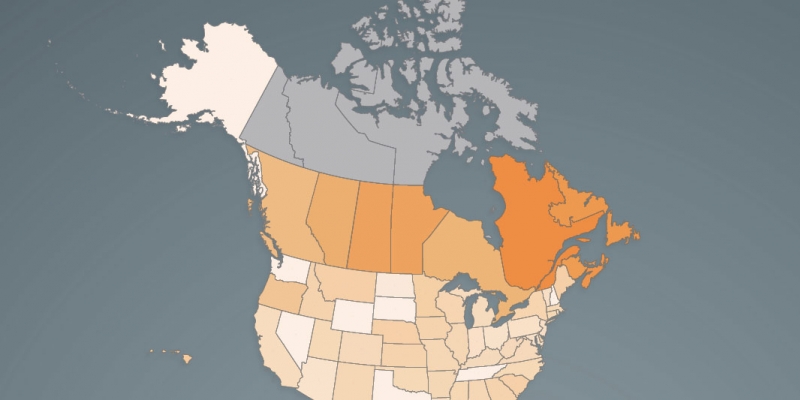

Read the Full Report View the Infographic - Income Tax Rate at CA$50,000

View the Infographic - Income Tax Rate at CA$50,000 View the Infographic - Income Tax Rate at CA$50,000 (Atlantic Canada)

View the Infographic - Income Tax Rate at CA$50,000 (Atlantic Canada) View the Infographic - Income Tax Rate at CA$75,000

View the Infographic - Income Tax Rate at CA$75,000 View the Infographic - Income Tax Rate at CA$75,000 (Atlantic Canada)

View the Infographic - Income Tax Rate at CA$75,000 (Atlantic Canada) View the Infographic - Income Tax Rate at CA$150,000

View the Infographic - Income Tax Rate at CA$150,000 View the Infographic - Income Tax Rate at CA$300,000

View the Infographic - Income Tax Rate at CA$300,000 Read the News Release - Canada

Read the News Release - Canada Read the News Release - Atlantic Canada

Read the News Release - Atlantic Canada

— Apr 3, 2024

— Mar 28, 2024

Read the Essay - Canada's Carbon Tax Plan is Beyond Policy Redemption

Read the Essay - Canada's Carbon Tax Plan is Beyond Policy Redemption Notes and References - Canada's Carbon Tax Plan is Beyond Policy Redemption

Notes and References - Canada's Carbon Tax Plan is Beyond Policy Redemption Read the Essay - Reforming the Federal Government's Carbon Tax Plan

Read the Essay - Reforming the Federal Government's Carbon Tax Plan Notes and References - Reforming the Federal Government's Carbon Tax Plan

Notes and References - Reforming the Federal Government's Carbon Tax Plan Read the News Release

Read the News Release

— Mar 26, 2024

— Mar 21, 2024

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.

Research Experts

-

Executive Vice President, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Professor of Economics, Lakehead University

-

Senior Fellow, Fraser Institute

-

Senior Economist, Fraser Institute

-

Professor of Economics, MacEwan University

-

Senior Fellow, Fraser Institute

-

Director, Fiscal Studies, Fraser Institute

-

Assistant Professor of Economics, George Mason University

-

Associate Director, Alberta Policy, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Senior Policy Analyst, Fraser Institute

-

Senior Fellow in the Centre for Economic Freedom, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Director, Addington Centre for Measurement, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Senior Fellow, Fraser Institute

-

President, Fraser Institute

-

Fraser Institute Founder and Honorary Director

-

Senior Fellow, Fraser Institute

-

Associate Director, Atlantic Canada Prosperity, Fraser Institute