Ontario government racks up massive debt and sticks Ontarians with the bill

The Ontario government carries one of the largest debt burdens in Canada, which represents a significant drag on provincial finances and a major cost for Ontarians. Heading into budget season, if the Ford government wants to finally tackle the province’s debt problem, it must restrain spending.

According to a recent study published by the Fraser Institute, Ontario’s net debt is expected this year to reach $416.1 billion, which is 84.9 per cent higher than in 2007/08. Moreover, government debt equals 38.7 per cent of the province’s economy (ranking below only Quebec and Newfoundland and Labrador) and on a per-person basis ranks second-highest at $27,091 (behind only Newfoundland and Labrador).

Clearly, Ontario has one of the highest government debt burdens in the country—but why does this matter?

High levels of government debt come with costs including interest costs. Just like when a family takes out a mortgage, governments must pay interest on the money they borrow. Two main factors determine interest costs—the interest rate and the total amount of debt. An increase in the interest rate and/or an increase in the amount of debt will increase interest costs.

Unsurprisingly, Ontario’s significant debt burden has produced significant interest costs. In 2023/24, the Ford government will pay $13.4 billion in debt interest, making it one of the largest single items in its budget. This is money unavailable for services or tax relief for Ontarians. For perspective, the government will spend more on debt interest than it expects to spend on post-secondary education.

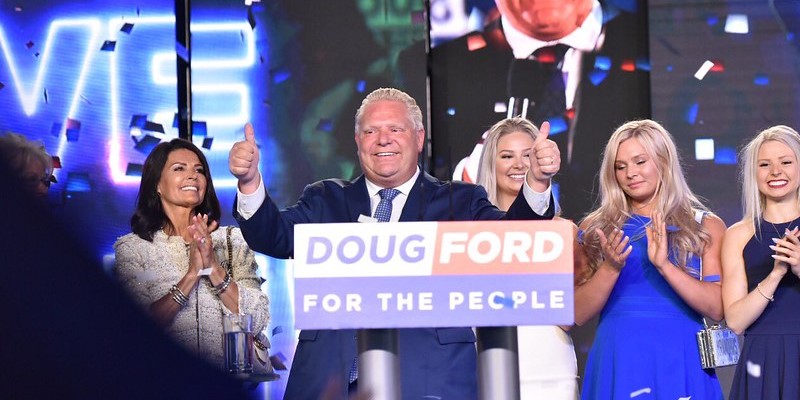

And the government can’t blame COVID. The Ford government has borrowed substantial sums of money before, during and after the pandemic and consistently increased spending and racked up debt despite singing a different tune when first elected in 2018 (former Ford finance minister Vic Fedeli pledged to take “immediate action to mitigate this fiscal mess”). But the Ford government’s promises have proven to be just words.

To be fair, the Ford government is not solely to blame. Successive Ontario governments have increased spending for many years, resulting in persistent budget deficits and ever-growing debt. Over the last 15 years, Ontario has run 14 budget deficits. But despite promising to change course on the campaign trail, the Ford government has chosen to continue the trend of higher spending and debt accumulation. Even when the Ford government ran an unexpected surplus in 2021/22 due to a revenue surge, it chose to further increase spending and run an unnecessary deficit the following year. Without spending restraint at Queen’s Park, Ontario’s debt problem will only get worse.

Ontario carries one of largest debt burdens in Canada, largely due to the provincial government’s unwillingness to control spending. As debt interest costs represent a growing drag on provincial finances, the Ford government should finally break its spending habits in Ontario’s upcoming budget.

Authors:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.