canadian government debt

Ottawa can expect to run deficits every year from now until 2051, racking up at least $900 billion in new debt.

The Liberal campaign platform has some laudable goals. However, one of the worrying policy initiatives, and one that is hopefully de-prioritized, is the raising of the top marginal federal tax rate on personal income from 29 to 33 per cent.

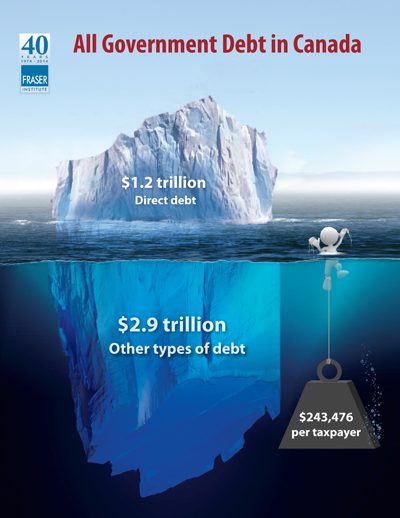

Imagine receiving a credit card bill that totaled $243,476. This would no doubt be a shock for most Canadians. But if you add up all the liabilities of every Canadian government "federal, provincial, and local" that is in fact how much each taxpayer would owe of the $4.1 trillion total in direct debt and unfunded liabilities.

This admittedly is a very large number and much bigger than what is usually talked about by both politicians and pundits alike. So let's deconstruct it to gain a better understanding.

When Canadas premiers met recently in Halifax, talks of a possible pipeline to move oil from Alberta to eastern Canada dominated national headlines. There was also mention of talks about trade, immigration, skills training, and infrastructure. One issue that didnt receive nearly as much attention is the management of public finances and growing government debt.

When Canadas premiers recently met in Halifax, talks of a possible pipeline to move oil from Alberta to eastern Canada dominated national headlines. There was also mention of talks about trade, immigration, skills training, and infrastructure. One issue that didnt receive nearly as much attention is the management of public finances and growing government debt.